Difference between revisions of "Taxes"

| Line 99: | Line 99: | ||

If you are not resident in Japan the total income in Japan will be low and so you will fall in a low tax bracket. Also no local tax will have to be paid. | If you are not resident in Japan the total income in Japan will be low and so you will fall in a low tax bracket. Also no local tax will have to be paid. | ||

| − | The first | + | The first 480,000 yen is the total income not taxed. After that the national tax rates are as follows: |

{| class="wikitable" | {| class="wikitable" | ||

Revision as of 12:58, 12 March 2021

For properties we manage we handle all the tax filings. At the end of the year we will provide the owner with the details and instruction how to file the relevant income taxes. For people living outside Japan we file a non-resident income tax return.

Contents

Possession Tax

Paid once a year. The invoice normally arrives on June 1st and needs to be paid by the end of June. It is possible to pay in 4 quarterly installments.

Normally about 0.3% to 0.5% of the market value each year, (peaks as high as 1.2%)

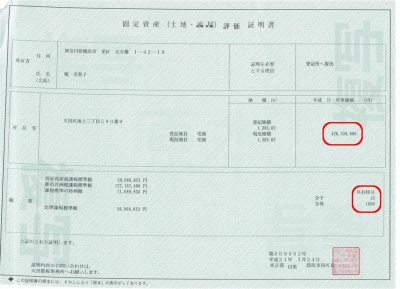

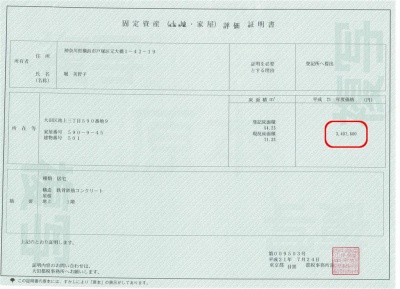

Computed as a percentage of the assessed land and building values.

Assessed values can differ wildly from the real market value.

More information can be found on this page of the Ministry of Land, Infrastructure, Transport and Tourism.

Acquisition Tax

This tax is due a few months after buying the property. Normally around 0.5 to 1.0% of the purchase price, it can peak as high as 2%. It is based on the assessed value and the calculation for residential property is as follows:

Acquisition Tax = Assessed Land Value x Share of the Land x 1.5% + Assessed Apartment Value x 3%

Commercial properties are taxed at 4% instead of 3%.

The assessed land and building value are published annually and available from the property records that are obtainable from the tax office. Here are examples of these property records.

There is a discount for newly built properties. More information can be found on this page of the Ministry of Land, Infrastructure, Transport and Tourism.

Stamp Duty

On any real estate contract both the buyer and the seller need to put a stamp. The stamps can be bought at the post office and the value is dependent on the transaction price. Mortgage contracts need a stamp too and the tax rates for this are slightly different.

| Transaction Amount | Property Purchase | Mortgage |

|---|---|---|

| 10,000 or less | nil | nil |

| 10,001 - 100,000 | 200 | 200 |

| 100,001 - 500,000 | 400 | 400 |

| 500,001 - 1,000,000 | 1,000 | 1,000 |

| 1,000,001 - 5,000,000 | 1,000 | 2,000 |

| 5,000,001 - 10,000,000 | 5,000 | 10,000 |

| 10,000,001 - 50,000,000 | 10,000 | 20,000 |

| 50,000,001 - 100,000,000 | 30,000 | 60,000 |

| 100,000,001 - 500,000,000 | 60,000 | 100,000 |

| 500,000,001 - 1,000,000,000 | 160,000 | 200,000 |

| 1,000,000,001 - 5,000,000,000 | 320,000 | 400,000 |

| more than 5,000,000,000 | 480,000 | 600,000 |

| if no amount is stated | 200 | 200 |

Income Tax

Rental income is part of your income and taxed as such. Maintenance, repair, management and financing costs can be deducted. Depreciation can be deducted too. If you are not resident in Japan the total income in Japan will be low and so you will fall in a low tax bracket. Also no local tax will have to be paid.

The first 480,000 yen is the total income not taxed. After that the national tax rates are as follows:

| Tax Base (Yen) | Tax |

|---|---|

| 1 - 1,950,000 | 5% |

| 1,950,001 - 3,300,000 | 10% of base exceeding 1,950,000 |

| 3,300,001 - 6,950,000 | 20% of base exceeding 3,300,000 |

| 6,950,001 - 9,000,000 | 23% of base exceeding 6,950,000 |

| 9,000,001 - 18,000,000 | 33% of base exceeding 9,000,000 |

| 18,000,001 and over | 40% of base exceeding 18,000,000 |

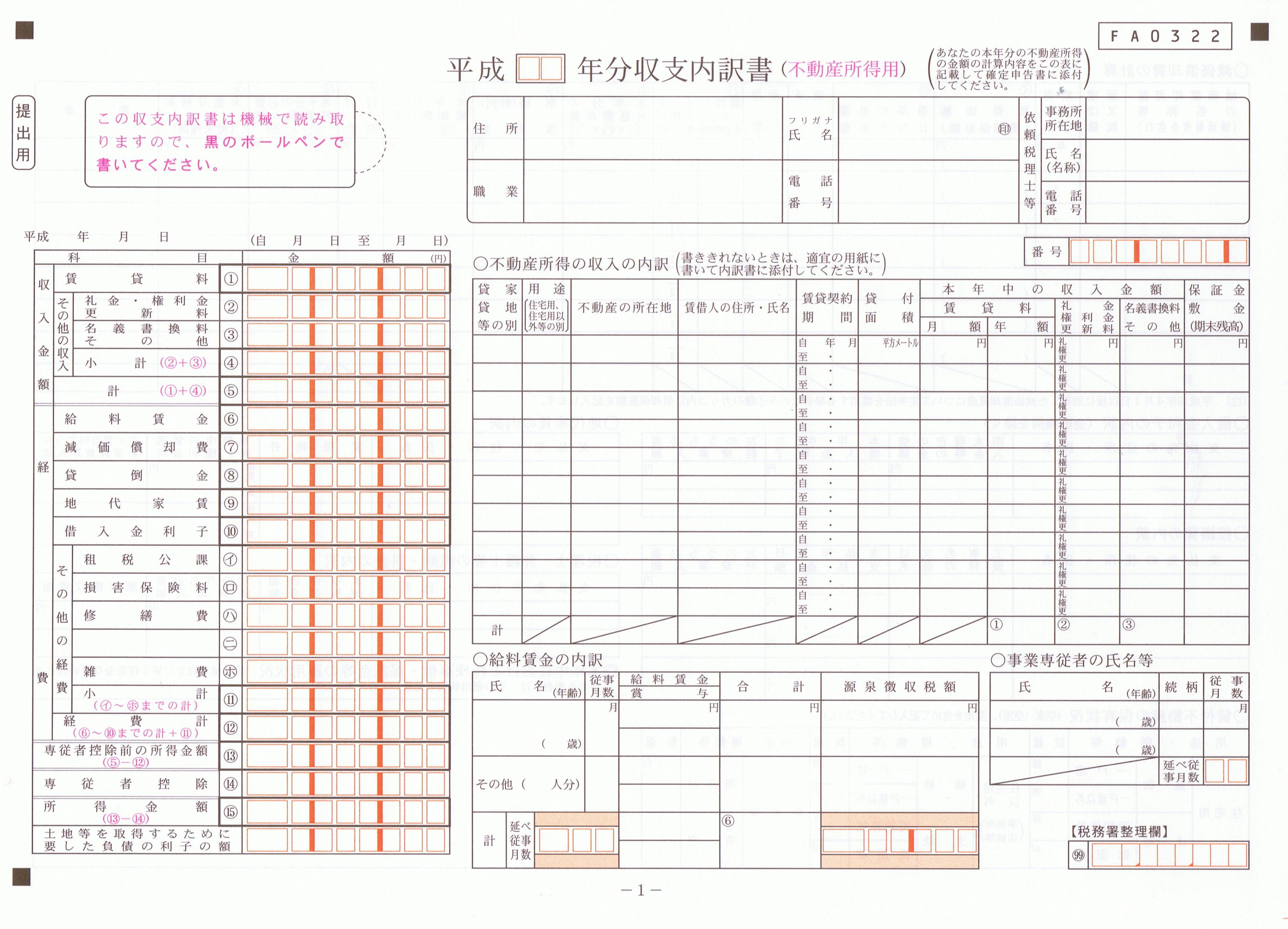

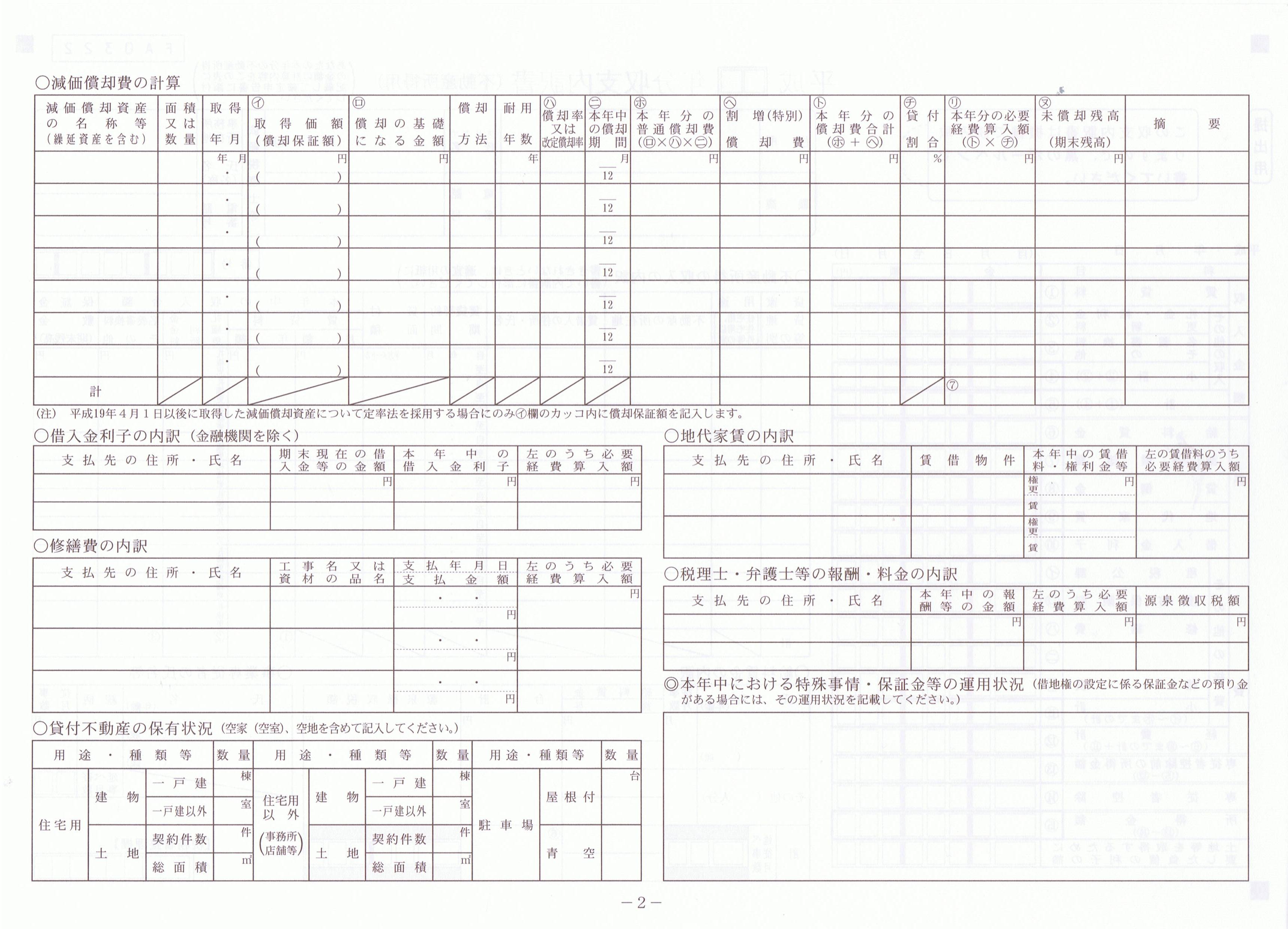

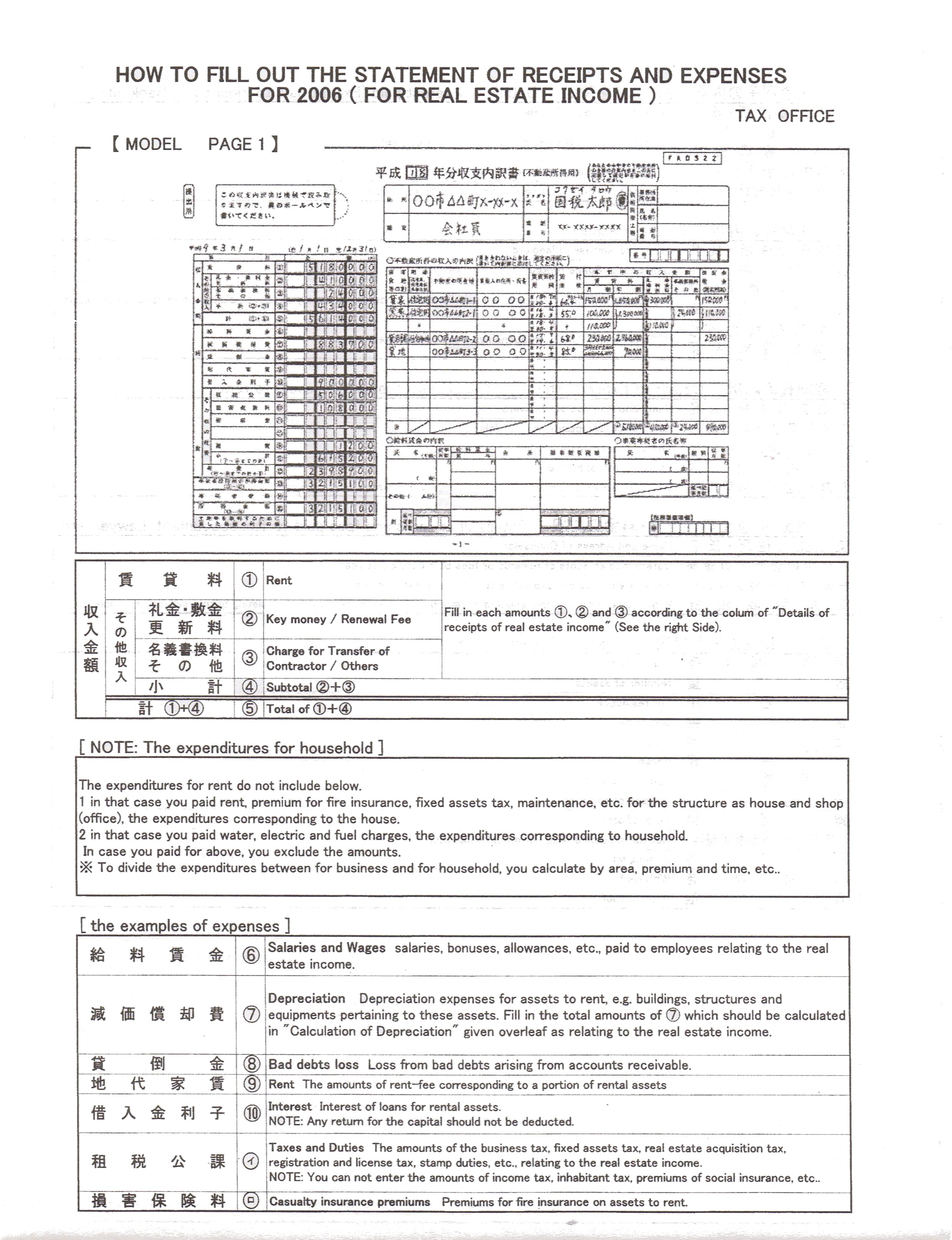

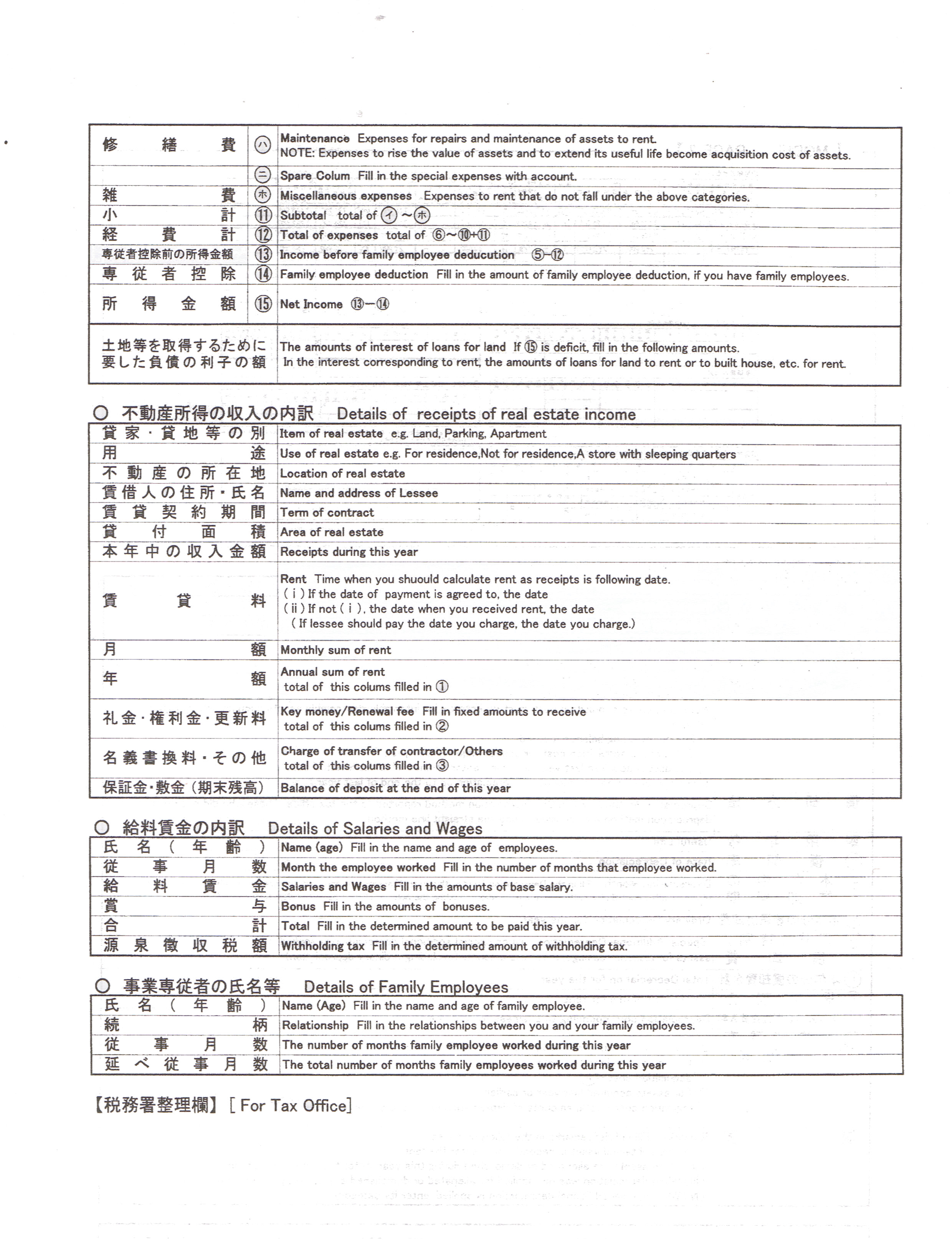

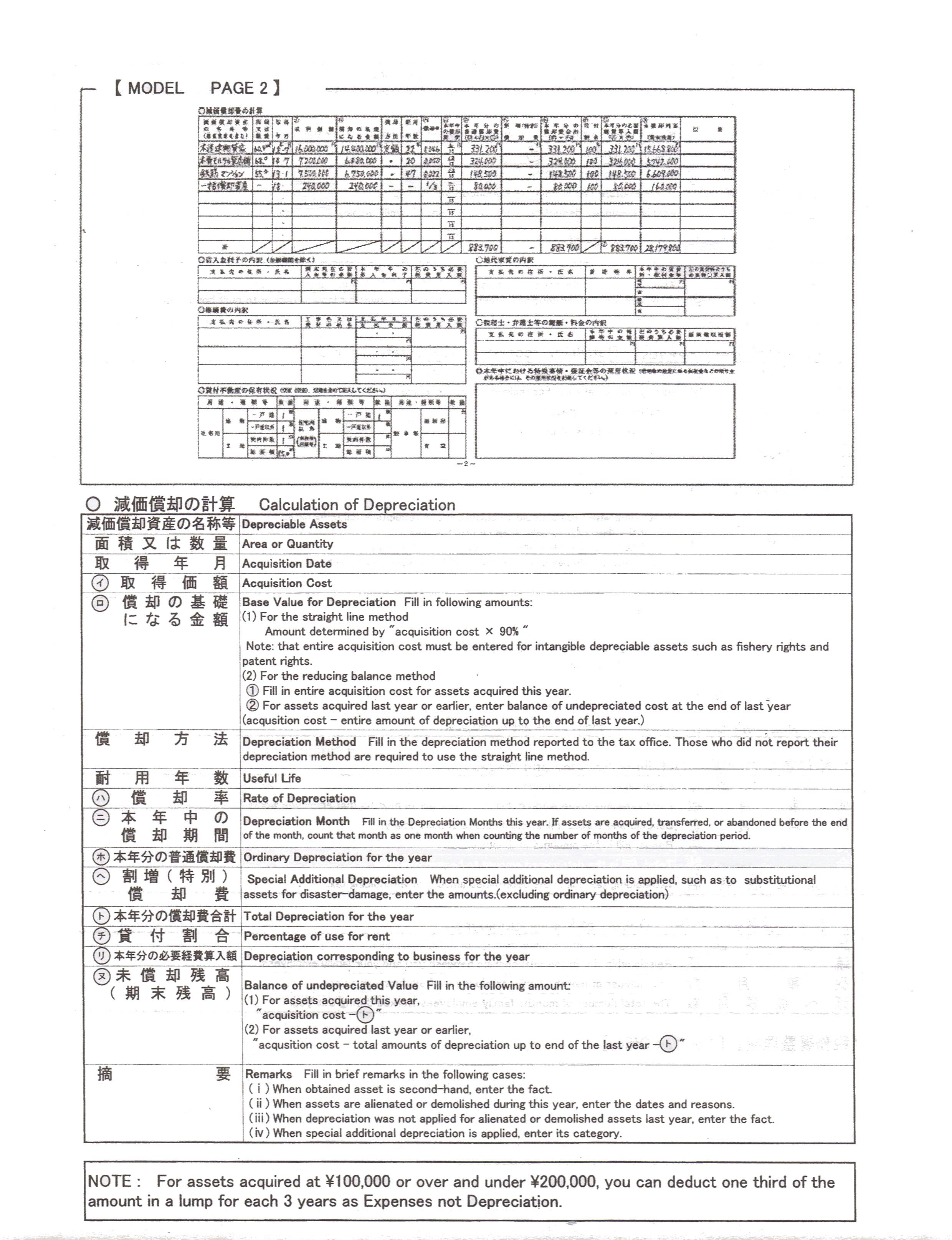

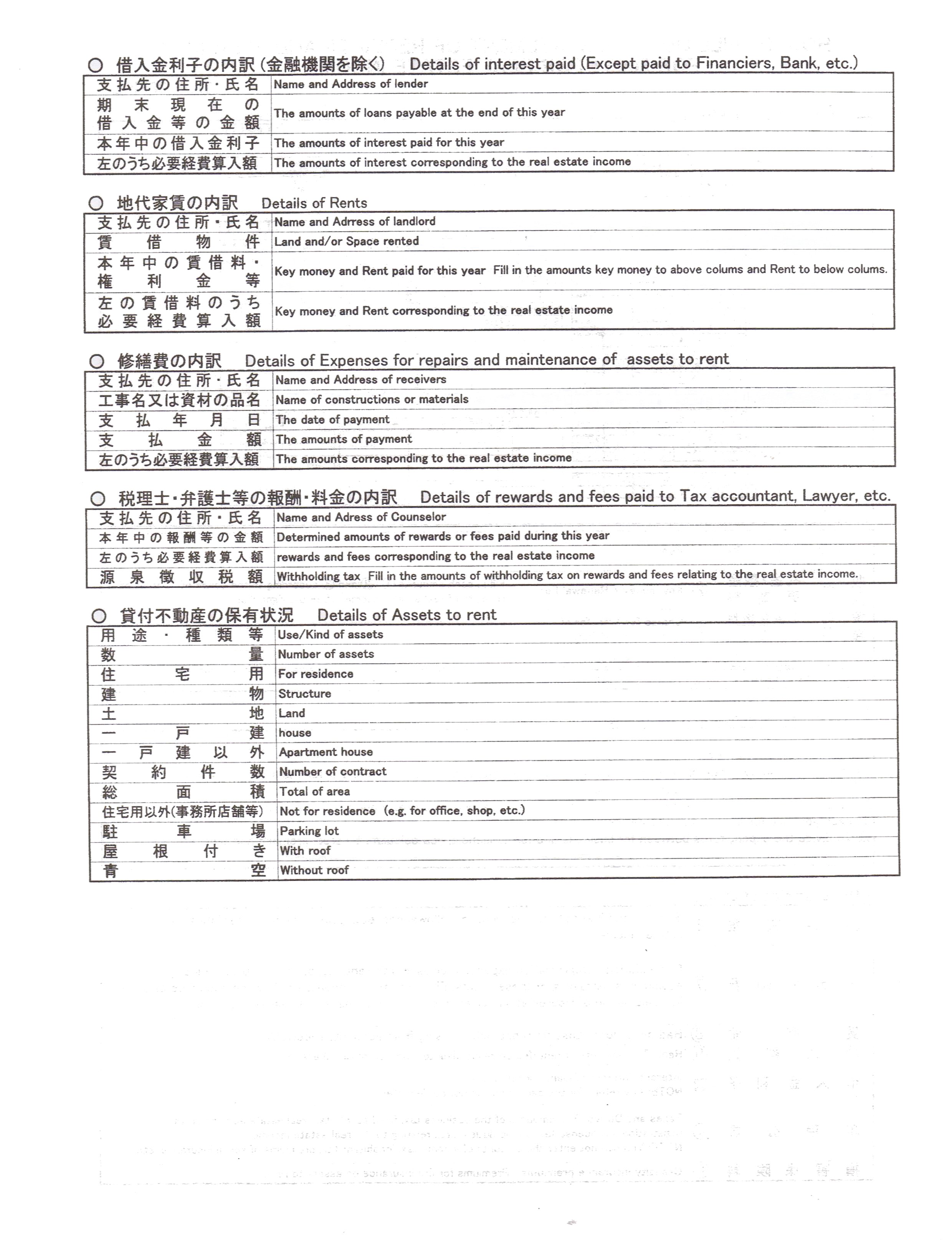

When filing personal income tax you are required to fill out two forms for the real estate income:

Depreciation Deduction for Income Tax

It is possible to use depreciation to reduce the income tax burden. In Japan it is only possible to depreciate the building, not the land. When purchasing a new structure, often the breakdown is given. However when purchasing a second hand property it is not clear how much can be declared as building value. One way it to look at the possession tax valuation of the building and land and take that ratio. Another option would be to use the Rosenka for the land valuation. When a property is sold, capital gains tax will have to be paid over the difference between the sales price and the book value. As depreciation reduces the book value, it will increase the capital gains tax when the property will be sold.

To calculate the depreciation you can depreciate the building in an amount of years, depending on what type of structure it is. This is called the 'useful life' in Japan.

| Building Type | Useful life |

|---|---|

| Steel frame reinforced concrete buildings or reinforced concrete buildings | 47 years |

| Brick, stone or block construction | 38 years |

| Metal construction (thickness of internal frame exceeds 4 mm) | 34 years |

| Metal construction (thickness of internal frame exceeds 3 mm) | 27 years |

| Metal construction (thickness of internal frame is 3 mm or below) | 19 years |

| Wood or wood composite construction | 22 years |

| Wood frame mortar construction | 20 years |

For second hand properties you can deduct 80 percent of the age. So for example a concrete apartment built in 1980 and bought in 2011 can be depreciated in 47 - (31 x 80%) = 47 - 24.8 = 22 years. The depreciation amount is 1/22 = 4.5% of the building value a year. When calculating the amount of years and the percentage depreciation the results are truncated down. It is not possible to depreciate a building more than its useful life, so a 40 year old wood frame structure must be depreciated in 20% of 20 = 4 years.

To reduce the income tax burden sometimes several strategies are suggested to maximize the depreciation. However there are also downsides to this approach. For example the building value on a new property is higher, so the taxable depreciation is higher as well. Unfortunately such a new property will suffer a real market depreciation as well. Another strategy is to purchase a very old wooden frame structure on cheap land, allowing to depreciate almost the full purchase price in just 4 years. However capital gains tax will need to be paid when selling the property, so this might only be interesting for temporary residents who are now paying a high income tax rate, but are expected to leave Japan and so will fall into the 15% capital gains rate when selling. Also such old wooden structures might incur high maintenance costs and are hard to manage as they are normally only found outside Tokyo.

Withholding for Income Tax

For non-residents the tax office wants to make sure that the income tax is paid. To this effect the law states that 20% of the incoming rent should be paid as withholding tax. When the annual income tax is filed by March the following year the owner will get a refund of these withholding tax payments.

Officially a withholding tax filing is the responsibility of the tenant and should be done for every rent payment. This entails filling out a tax form, making the payment and sending a copy of the payment slip to the owner. Clearly this would create an excessive amount of paperwork and so the tax office is willing to take a rather flexible approach. This means that normally there is no issue if the withholding tax is not filed in case both the renter and the owner are individuals. If the renter is a corporation however they have requested that the payments are made for larger rent payments, but they are willing to let the property manager handle it. The exact definition of 'large' has not been given, but so far we have managed to avoid this paperwork for rents below 200,000 yen a month.

How to file

For residents just take the proof of your other income like your salary slips to the tax office along with the real estate forms. If your additional income is less than 200,000 yen no filing is necessary.

Capital Gains

On short term holdings (less than 5 years) the tax rate on capital gains is quite high at 39% (30% national + 9% local tax). But there are ways to reduce it to 15% or less. If the dwelling is used as a primary residence the first 30 million yen of capital gains is tax free. A couple owning a house jointly gets 60 million tax free. If you own a property more than 6 years the tax rate goes down to 20% (15% national and 5% local tax). If you are not a resident in Japan that means the tax is 15%. Between 5 and 6 years it depends on the time of year. To get the lower tax rate 6 times January 1st must have passed since the purchase.

Withholding for Capital Gains

To ensure a non-resident seller files the capital gains tax form the buyer needs to withhold 10% of the sales price and pay this in withholding tax. The seller then can claim this back by filing the correct papers. For leasehold the amount is 20%.

Entrepreneurial Tax

Individuals owning on their personal title 10 or more apartments or 2 or more buildings are charged an extra 5 percent of the profit when filing their personal income tax. The first 2,900,000 yen profit tax not taxed though. There is some rounding involved as well. Here is an example:

- Income: 4,993,170 yen

- Deduction: 2,900,000

- Taxable: 2,093,000 (rounded down to the lowest thousand yen)

- 5% tax: 104,600 (rounded down to the lowest 100 yen)

To avoid this tax we recommend to divide ownership of many apartments over the different family members. It is also possible to put the ownership in a limited company and then pay yourself a salary as a director. For residents this salary would be taxed as income. For non-residents there is a flat tax of 20% on income distributions. A further advantage of having a company structure is the possibility to deduct travel and entertainment expenses. The initial set-up costs for a company in Japan are around 250,000 to 500,000 yen. Annual corporate tax will be 70,000 yen if all income is distributed as salary. The annual tax filing would cost around 150,000 to 300,000 depending on the complexity.

Sales Tax

No sales tax is levied on residential rental contracts. For corporate contracts 8% sales tax is added. However if the owner is an individual and the total rent is less than 10 million yen a year, the owner can keep this money and does not have to file a sales tax form.

Direct ownership versus a holding company

As a direct owner you have to pay income tax at progressive rates over the profit made from the investment properties. For large investors it can be a good idea to set up a local Japanese company (kabushiki kaisha) to reduce the tax burden. Setting up a company takes around 3 months and costs about 300,000 to 500,000 yen. The annual accounting costs might be similar. In return it is possible to deduct for example entertainment expenses and many more items from your profit. You would have to put yourself and possibly other people on the payroll to avoid paying the high corporate taxes. This could allow you to spread the income over several people making sure to avoid those higher tax bands. For non-resident directors there is a fixed tax rate of 20%. For more details we can recommend to talk to Greg McDonald at SolidJapan.

Putting Japanese property directly in an overseas holding company might not be an effective way to save taxes. In such circumstances the tax rate would be 20% of the rent without allowing any deductions. Also the property manager would have to file a withholding tax form and make a payment with the tax office for EVERY rent payment. If overseas ownership is required a special construction called a Tokumei Kumiai (TK) should be set up instead. However this is only suitable for larger investments (JPY 200 million and over) given the fact that non-residents pay very low tax rates on smaller investments.